If you create a Machine Learning model to predict the price of a stock:

How can you evaluate its performance if you apply it to your investment strategy?

Data

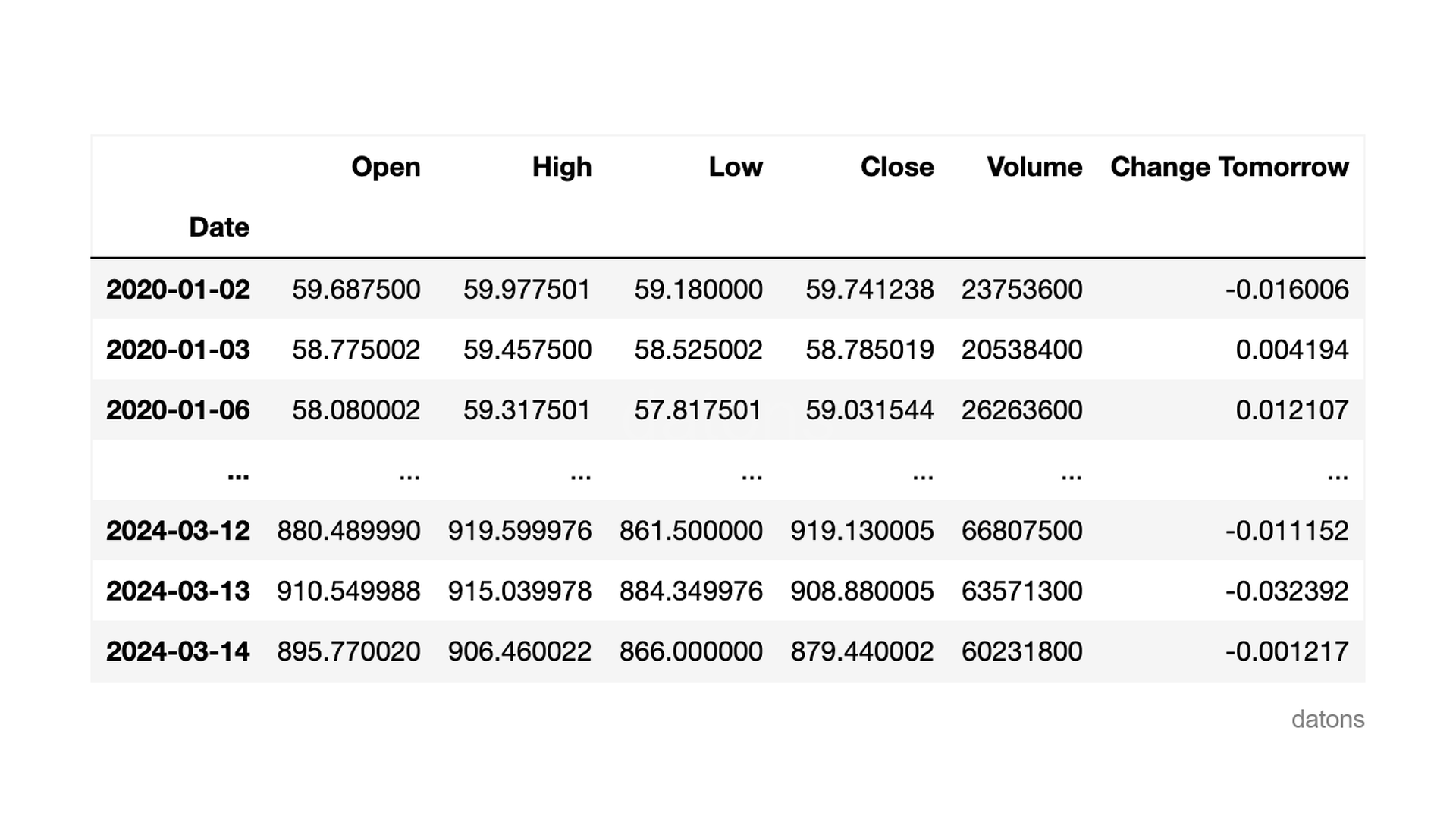

We start with the stock data of NVIDIA

with its ticker NVDA.

Check out this tutorial to learn how to preprocess the daily return of a stock.

import pandas as pd

df = pd.read_csv('data.csv', index_col='Date', parse_dates=True)

Questions

- How is a Machine Learning model implemented to predict the change in closing price?

- What is the role of the

min_samples_leafparameter in theDecisionTreeRegressoralgorithm? - How do we measure the model’s error and what does it tell us about its performance?

- How do we introduce a Machine Learning model into an investment strategy?

- How do we evaluate the performance of the Machine Learning investment strategy?

Methodology

Feature selection

We want to predict the percentage change in tomorrow’s closing price. This will be the target variable, and the rest will be the explanatory ones.

target = 'Change Tomorrow'

y = df[target]

X = df.drop(columns=target)Machine learning model

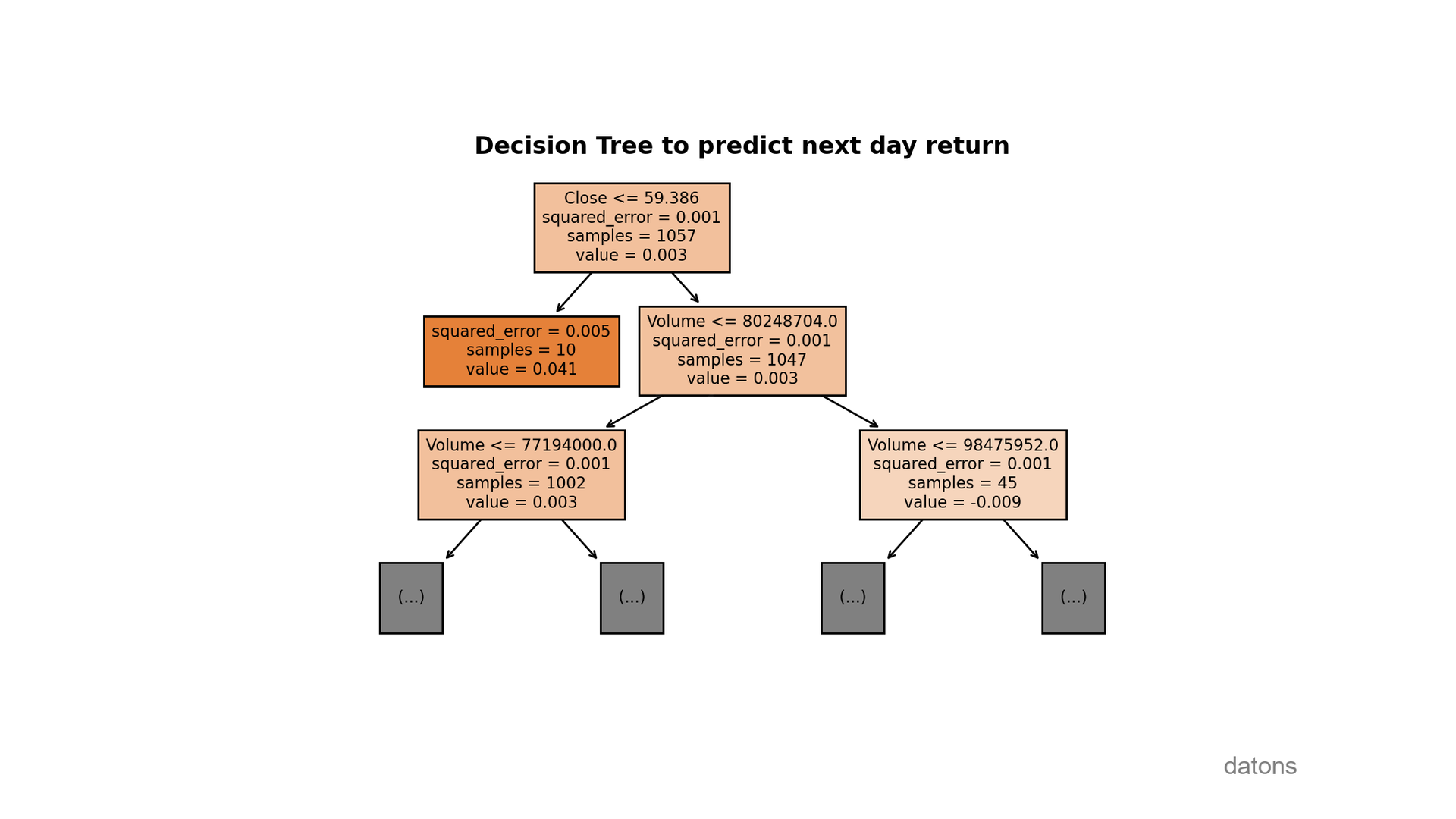

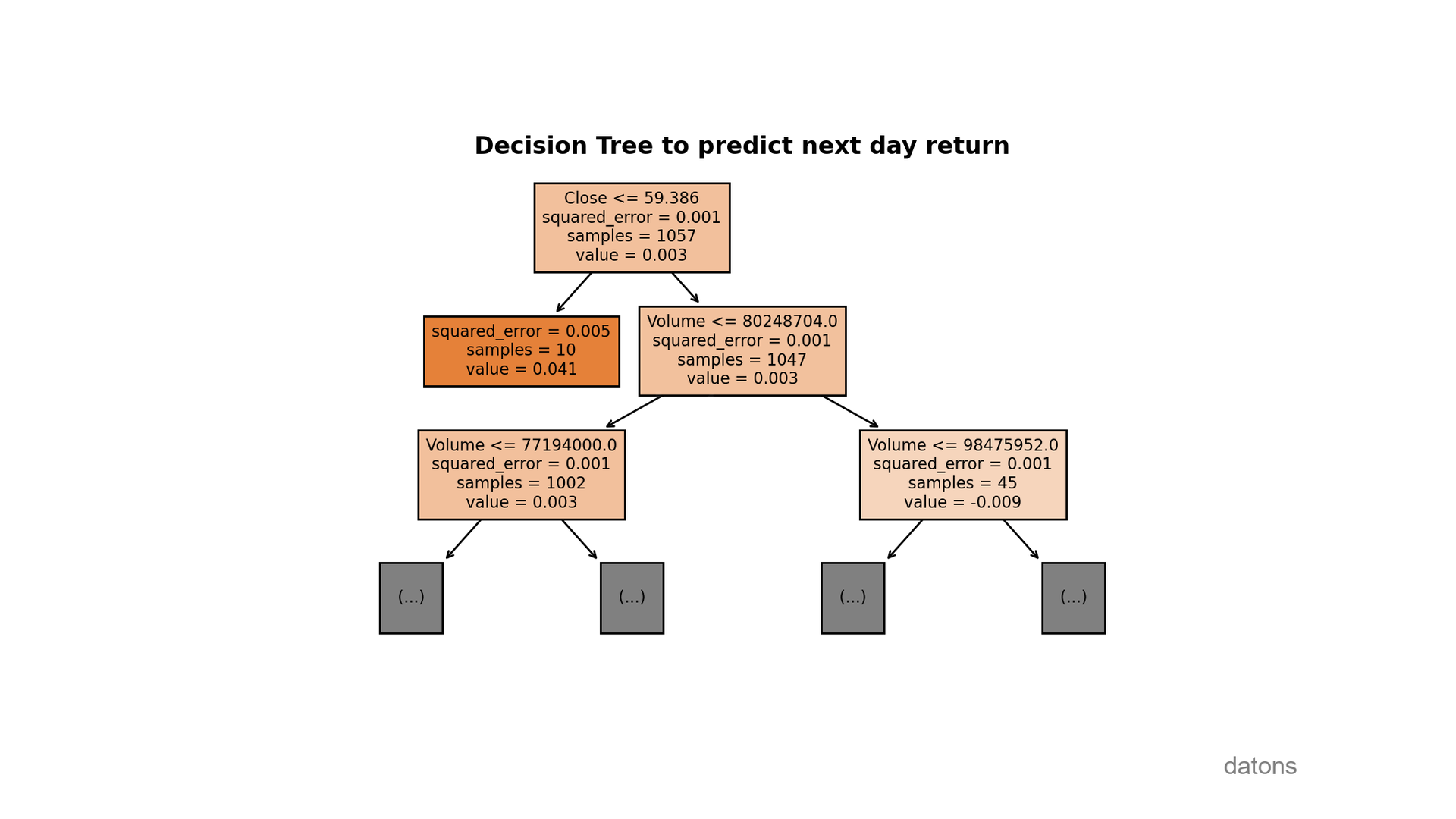

We will use the DecisionTreeRegressor algorithm to

predict the change in the closing price.

As a minimum, we want there to be 10 samples at the end of each

branch of the tree, min_samples_leaf=10.

from sklearn.tree import DecisionTreeRegressor

model = DecisionTreeRegressor(min_samples_leaf=10)

model.fit(X, y)

Model evaluation

With the model’s mathematical conditions, we calculate the model’s predictions:

y_pred = model.predict(X)And compare them with the actual values, thus obtaining the error.

error = y - y_predTo have a better evaluation metric of the model, we calculate the root mean square error (RMSE); it usually tells us how much the predictions deviate from the actual value 68% of the time.

error2 = error ** 2

MSE = error2.mean()

RMSE = MSE ** 0.5In our case, the prediction of the percentage change for tomorrow that the model makes will deviate on average 2.99% from the actual value.

Is this an acceptable value for our investment strategy? How could we improve it?

I read your comments to design the next tutorial.

Now let’s continue with the implementation of the investment strategy

using the backtesting.py library.

Create investment strategy

To implement the investment strategy, we create a class that inherits

from backtesting.Strategy functionalities.

For this, the class requires two methods: init and

next.

init: initializes the strategy with the previously calculated model.next: calculates the prediction for tomorrow and decides whether to buy, sell, or do nothing.

from backtesting import Strategy

class MLStrategy(Strategy):

def init(self):

self.model = model

def next(self):

X_today = self.data.df.iloc[[-1]]

y_tomorrow = self.model.predict(X_today)

if y_tomorrow > RMSE:

self.buy()

elif y_tomorrow < -RMSE:

self.sell()

else:

passBacktest with trading conditions

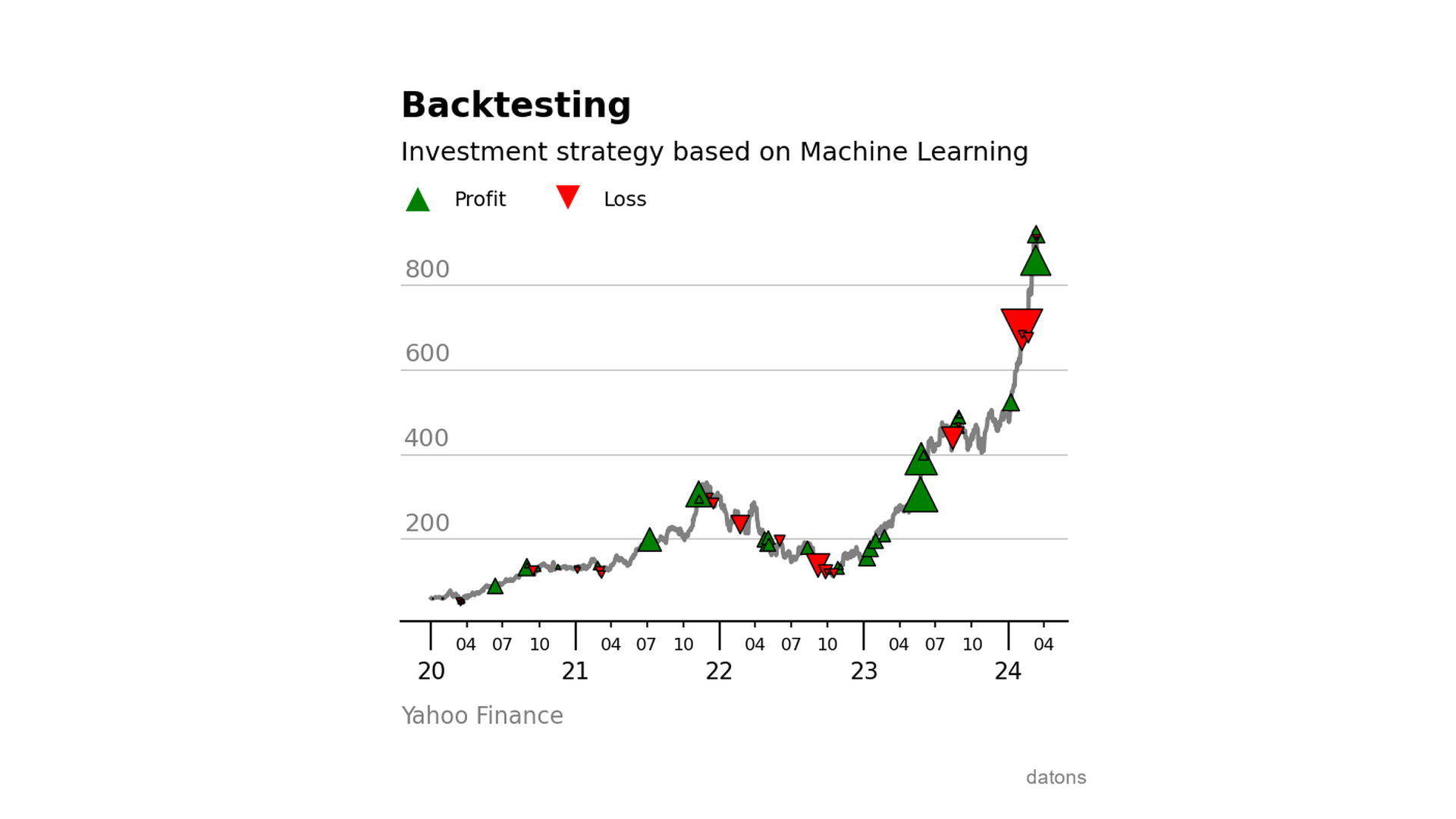

Finally, we simulate the investment strategy (aka backtest) with the following conditions to evaluate its performance.

from backtesting import Backtest

bt = Backtest(

X, MLStrategy, cash=1_000, commission=.002,

exclusive_orders=True, trade_on_close=True

)

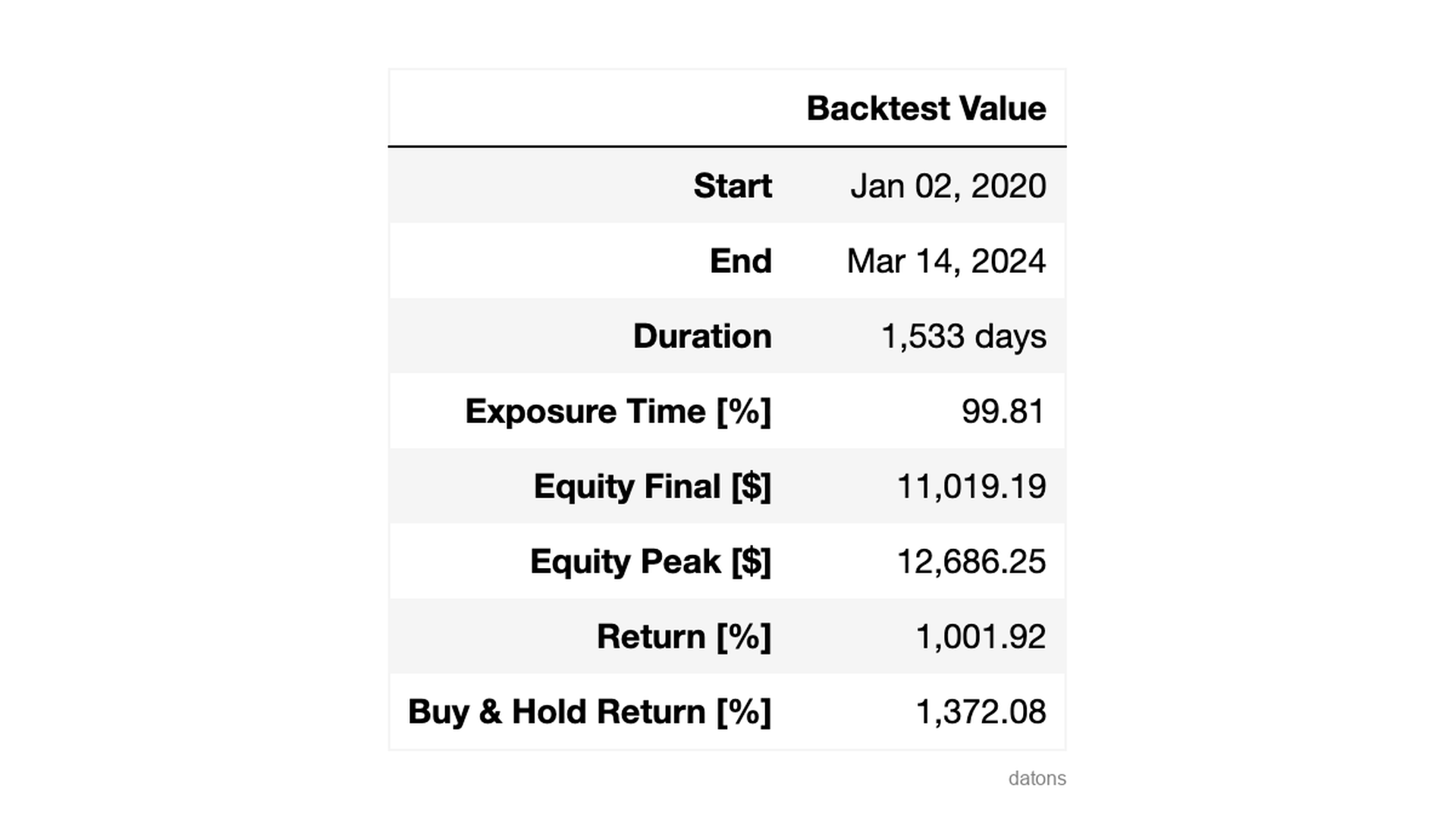

results = bt.run()In the backtest report, we observe that, after 1,533 days, we obtain

a Final Equity of $11,019.19.

Although it would have been easier to buy and hold the stock without

a Machine Learning model; obtaining a Return of 1,372.08%

(vs. 1,001.92%).

How could we improve the Machine Learning investment strategy? I read your comments.

Visualize backtest simulation

Finally, we visualize the backtest simulation to better understand the performance of the investment strategy.

bt.plot()In addition to performance metrics, we observe one that is crucial

for evaluating the investment strategy: the Drawdown.

This metric tells us how much we would be willing to suffer without closing the position.

In other words, Drawdown measures the risk of the investment strategy.

If you want to delve into integrating Machine Learning models into investment strategies, I invite you to check out this course.

Conclusions

- Machine Learning Model:

DecisionTreeRegressoris a tree algorithm that selects the most significant historical patterns to predict changes in prices. - Parameter

min_samples_leaf:min_samples_leaf=10prevents overfitting by ensuring a minimum number of samples in the tree leaves, improving the model’s generalization. - Error Measurement:

RMSEto quantify the deviation of predictions from actual values with 68% confidence. - Introduction in Investment Strategy:

Strategywithinitandnextintegrates the model’s predictions into trading decisions. - Performance Evaluation:

Backtestallows us to simulate the investment strategy with customized trading conditions.