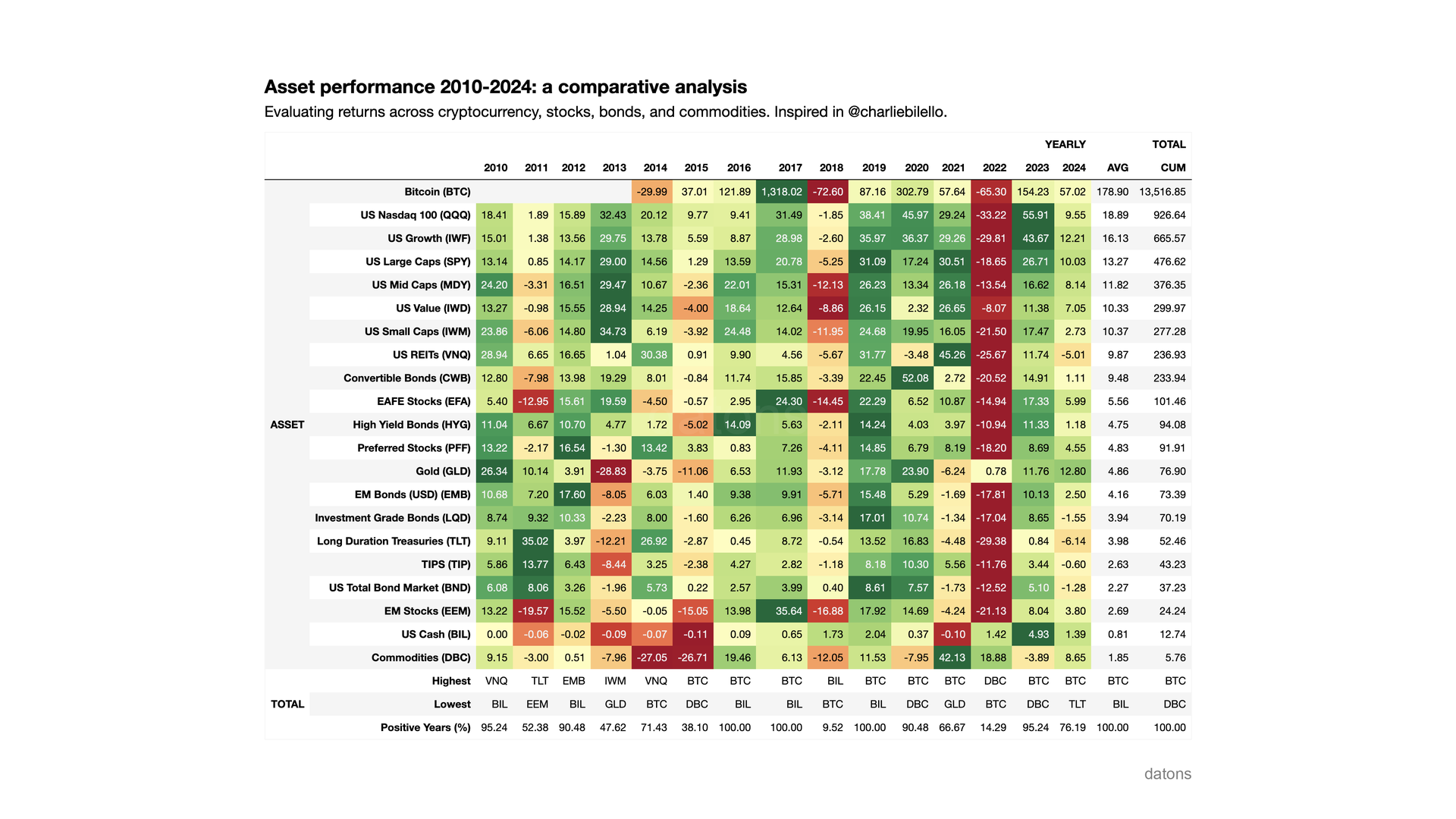

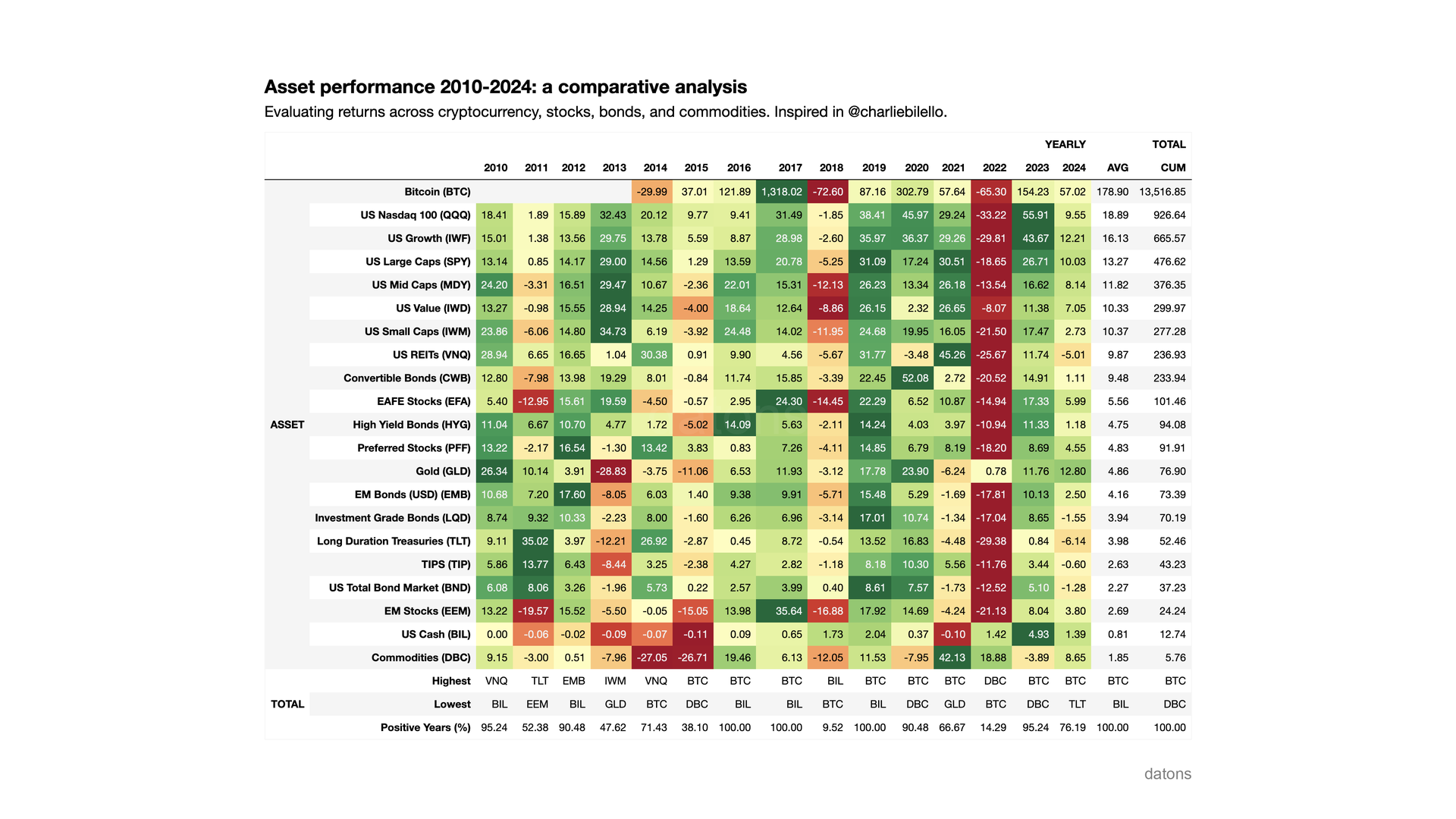

When comparing the performance of financial assets like Bitcoin, ETFs, and stocks, which was the most profitable asset since 2010?

In this tutorial, we explain how to download, process, and report on the performance of financial assets using Python.

The report is inspired by Charlie Bilello’s analyses.

Data

We define the list of tickers for the assets to analyze.

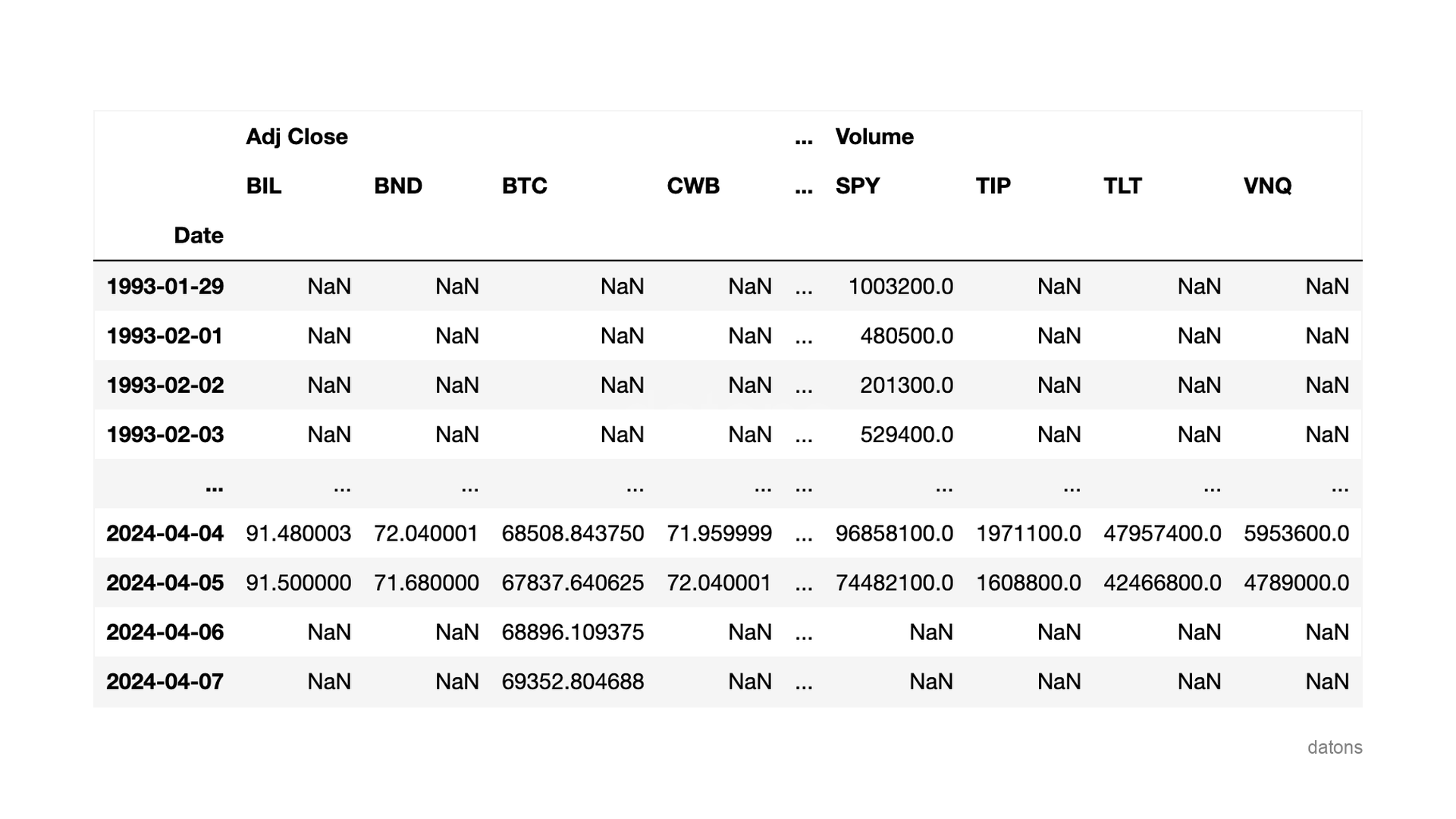

tickers = ['BTC-USD', 'QQQ', 'IWF', 'SPY', ...]We download daily historical price movements using the

yfinance library, which downloads data from Yahoo

Finance.

import yfinance as yf

df = yf.download(tickers)

Questions

- How to download historical price data for multiple financial assets?

- How to calculate the annual cumulative return of each asset?

- Why is it necessary to group data for cumulative calculations?

- How to select the last day of cumulative return in each year?

- How to identify the maximum and minimum return values in each year?

- How to calculate the percentage of positive returns for each asset?

Methodology

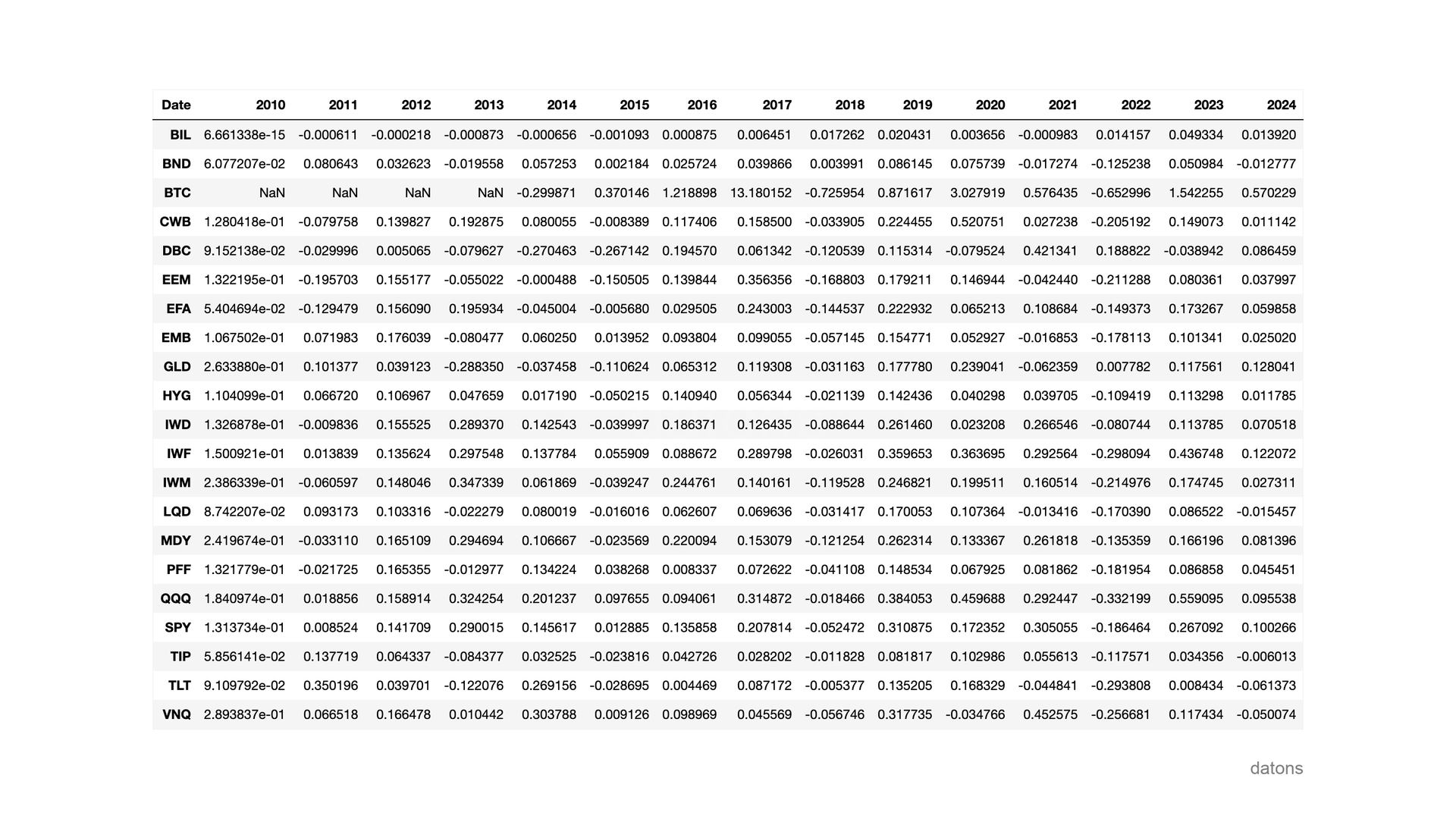

Annual cumulative return

We select the adjusted closing prices Adj Close from

2010 and calculate the annual cumulative return, choosing the last

business day of each year.

(df

.loc['2010':, 'Adj Close']

.groupby(df.index.year).pct_change().add(1)

.groupby(df.index.year).cumprod().sub(1)

.resample('YE').last().T

)BTC-USD (Bitcoin) shows missing values in the early

years due to its regulation and adoption (see the full story on Wikipedia).

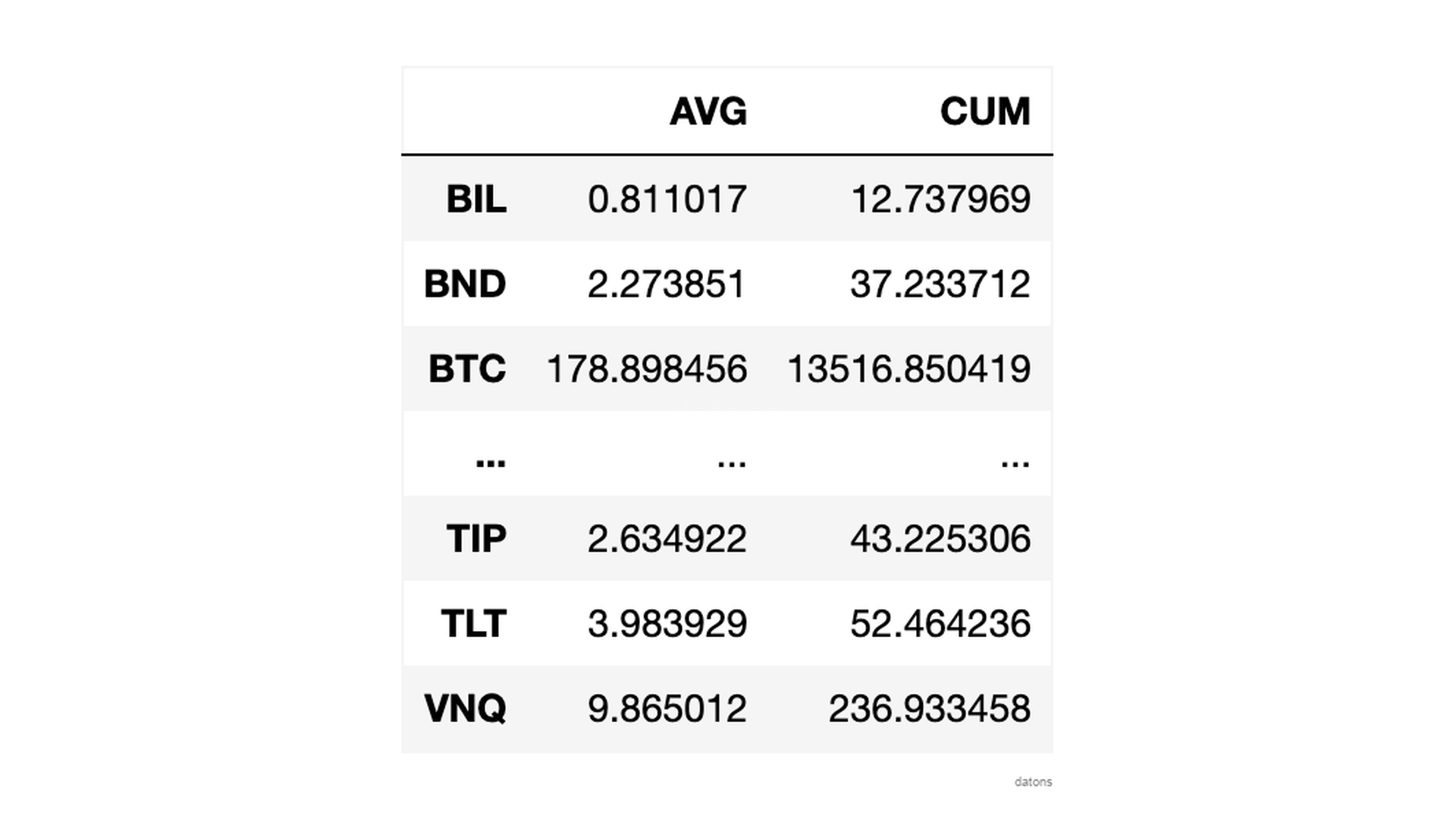

Column summary

How did the assets perform over the years?

We calculate the average annual return and the annual cumulative return for each asset.

For more details on the calculation of returns, visit this tutorial.

t_avg = df.mean(axis=1).mul(100)

t_cum = df.add(1).cumprod(axis=1).sub(1).mul(100).iloc[:,[-1]]

pd.DataFrame({'AVG': t_avg, 'CAGR': t_cum})

Row summary

What were the maximum and minimum values each year? What was the percentage of positive returns?

positive_pct = lambda x: (x > 0).mean() * 100

dfr.agg(['max', 'min', positive_pct])All assets showed positive cumulative returns at the end of the

period, with BTC-USD being the most profitable asset.

Combining and styling

Finally, we combine all tables and apply styling to highlight maximum and minimum values.

This tutorial explains how to apply styles to pandas tables to create a heat matrix this tutorial.

Why did almost all assets show negative returns in 2022?

Looking forward to your comments.

Conclusions

- Downloading historical data:

yf.download(tickers)to get data for multiple financial assets from Yahoo Finance. - Calculating annual cumulative return:

.pct_change().add(1).cumprod().sub(1)to determine an asset’s performance over time. - Grouping data for cumulative calculations:

groupby.cumprodto reset cumulative calculations at the start of each year. - Selecting the last day of cumulative return:

.resample('Y').last()to find the final value of each year, useful for annual analysis. - Identifying maximum and minimum values:

.agg(['max', 'min'])to discover the extremes in annual asset performance. - Calculating the percentage of positive returns:

lambda x: (x > 0).mean() * 100to evaluate the frequency of an asset’s gains.

In addition to this tutorial, you can learn more with our live courses.

I’ll teach you the best practices for writing more efficient code in fewer lines and address your questions, all while working on practical cases with data that interests you.

For more info, visit datons