In trading platforms, you can request buy or sell orders on a financial asset.

You can program a bot to execute your orders to automate your operations.

In this tutorial, you’ll learn to request orders programmatically with the Alpaca API using a demo account.

Disclaimer: This tutorial is for educational purposes to teach you to program with practical cases. It is not an investment recommendation.

Questions

- How do you authorize the code to execute trading operations with your Alpaca account?

- What general information do you have about your demo account?

- How do you create a buy order for a financial asset?

- What does the

GTCparameter mean in a buy order? Why is it important? - How do you close an open position on a specific asset?

- How do you view updated information on your portfolio after performing operations?

Methodology

Create an Account on Alpaca

Register at Alpaca and generate an API Key to validate your programmatic access.

To avoid risks, do not register any payment method when creating your account.

API_KEY = 'YOUR_API_KEY'

API_SECRET = 'YOUR_API_SECRET'Account Properties

Once you have installed the Alpaca library:

pip install alpaca-pyYou create the trading client instance in demo mode,

paper=True, to validate your connection to the API.

from alpaca.trading.client import TradingClient

client = TradingClient(API_KEY, API_SECRET, paper=True)Request your account information to verify that everything is in order.

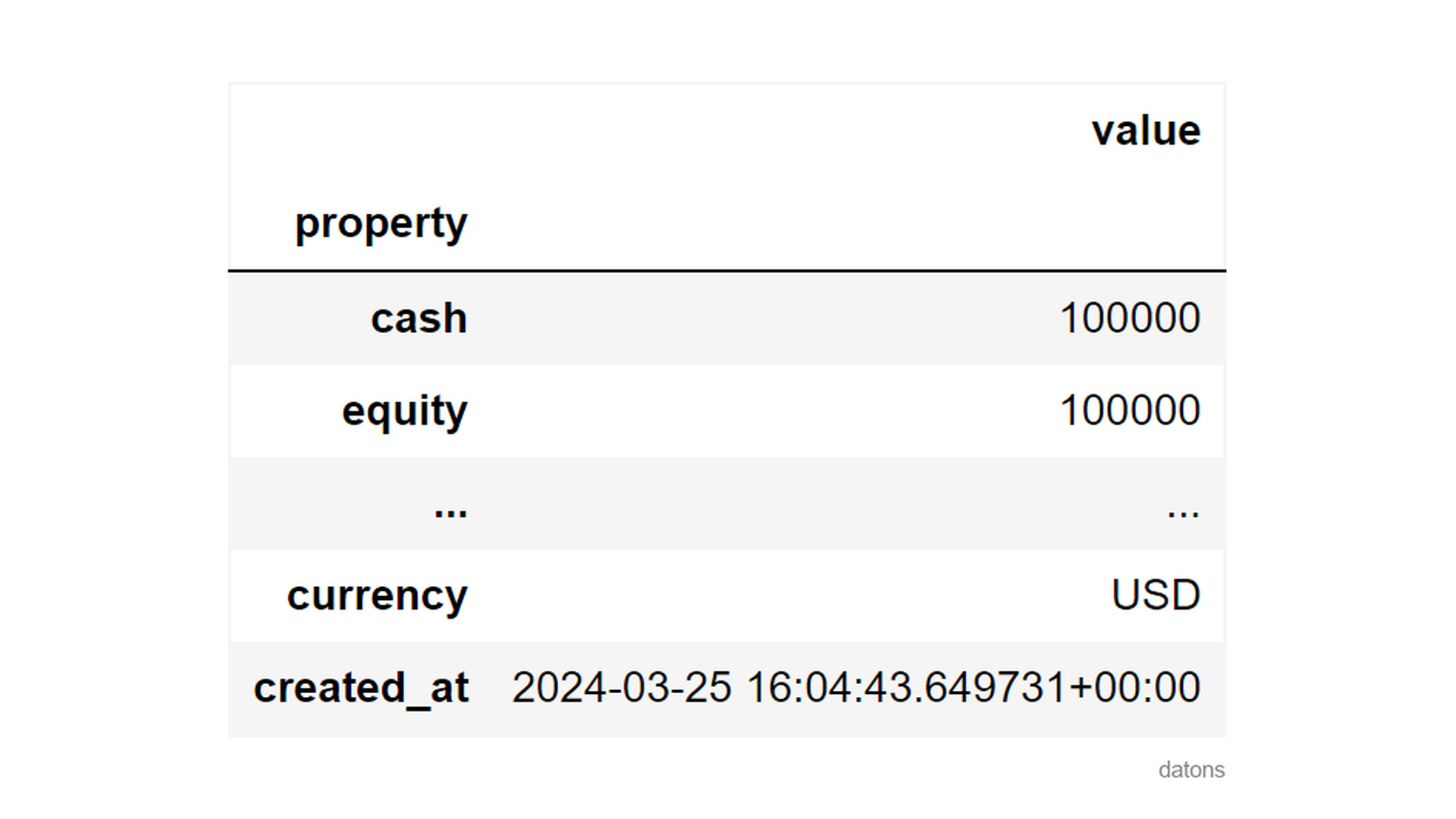

data = client.get_account()You start with a balance of $100,000 in your demo account.

Request First Order

Let’s go all-in on Bitcoin BTCUSD with the

available balance.

To register the order, create a MarketOrderRequest

object specifying the conditions.

notionalis the amount of money you want to invest in the order. If you want to buy a specific number of shares, you should use the qty parameter.GTCGood Till Cancelled indicates that the order will remain active until executed.

order = requests.MarketOrderRequest(

symbol='BTCUSD',

notional=100_000,

side=enums.OrderSide.BUY,

time_in_force=enums.TimeInForce.GTC,

)

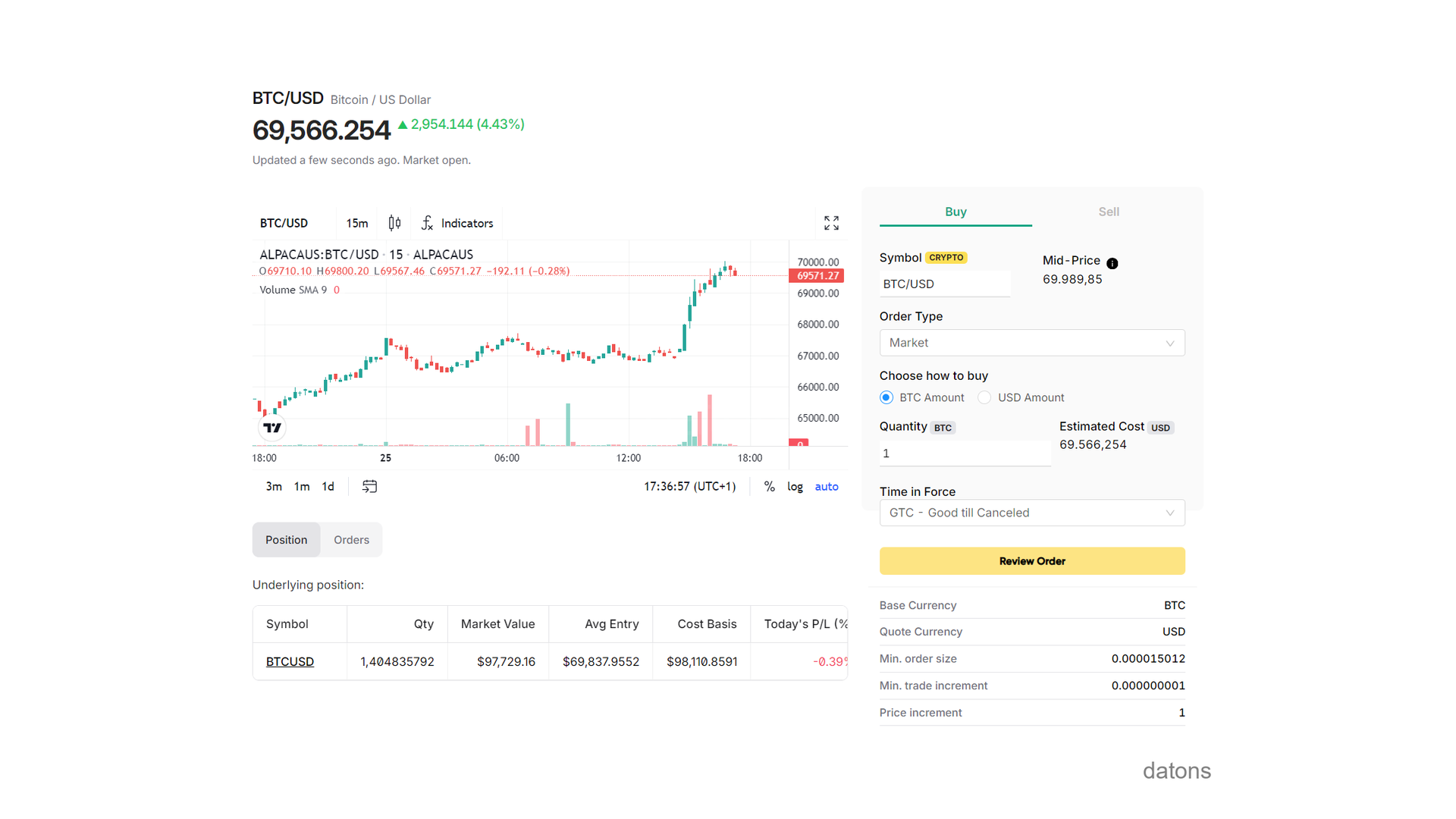

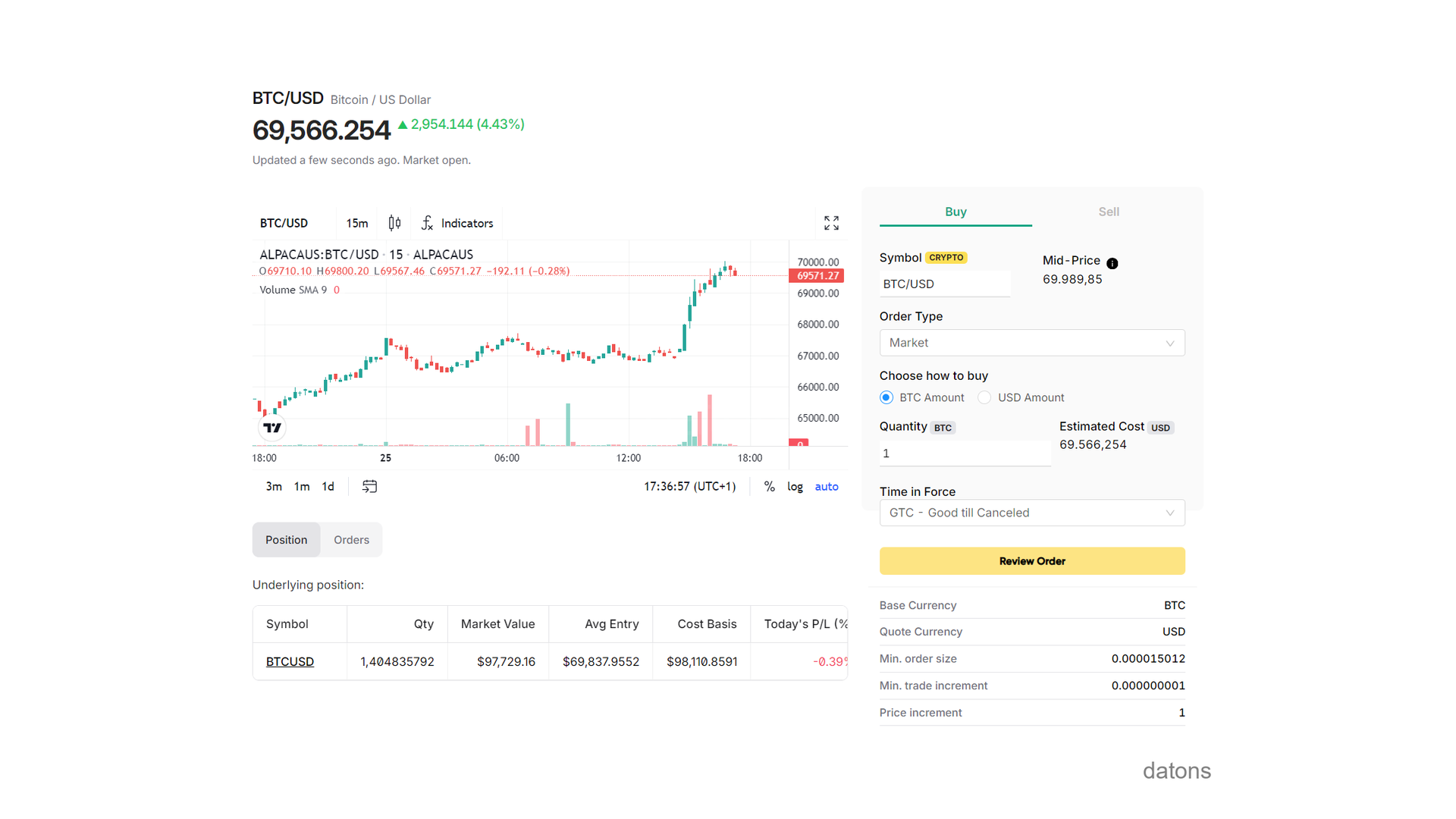

client.submit_order(order)If you visit your active orders, you’ll see the buy order for Bitcoin.

Would this be interesting to one of your friends? Share it with them.

In our case, the order was executed by buying 1.40 Bitcoins at an average price of $69,837.9552.

The execution of the order in Bitcoin should be immediate. However, for other financial assets, the order may take time to execute.

Close Asset Position

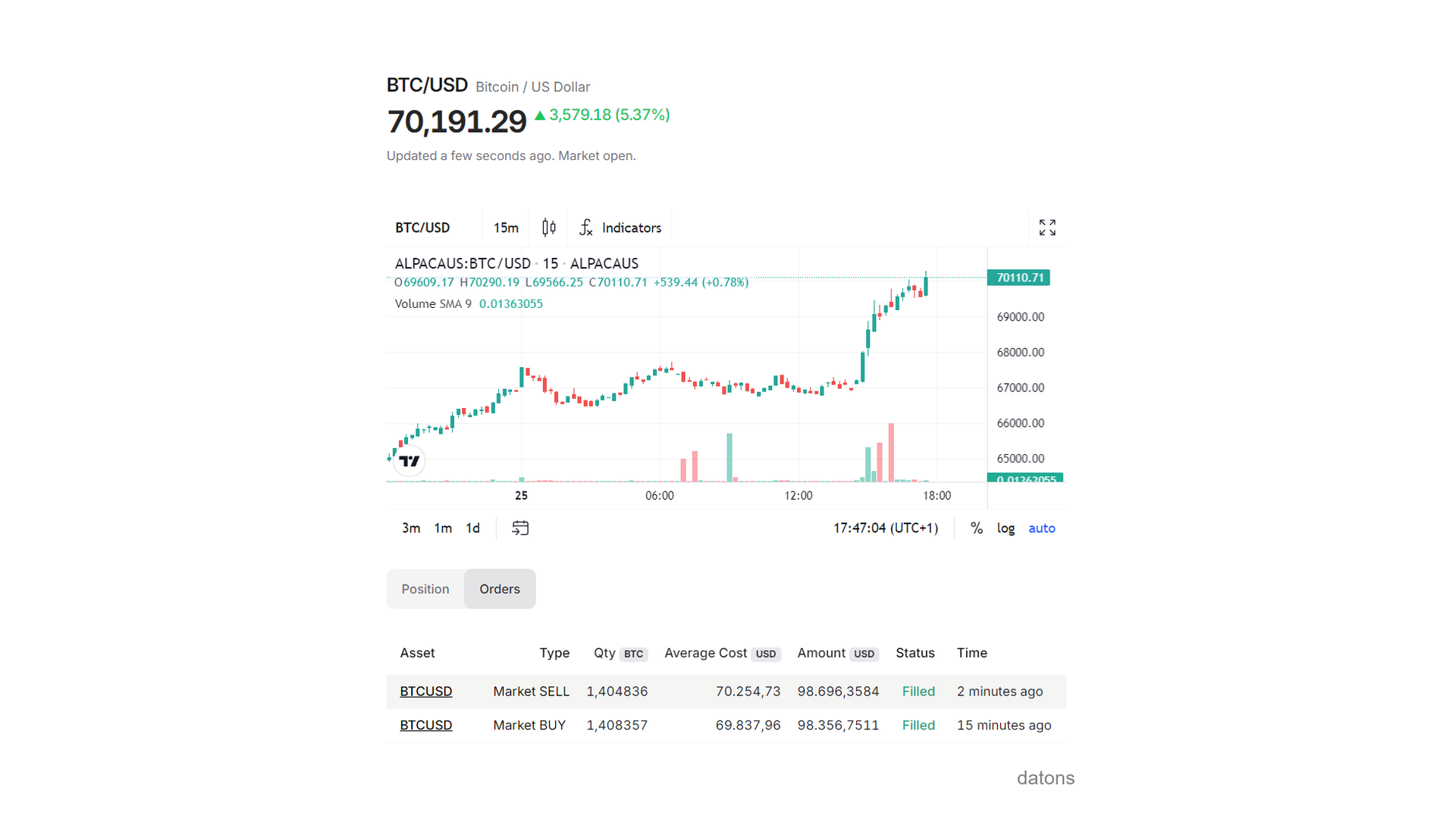

Now, you have an asset as an open position in your account.

To close the position, you’ll need the asset_id of the

asset.

position = client.get_open_position('BTCUSD')

client.close_position(symbol_or_asset_id=position.asset_id)

Portfolio Balance

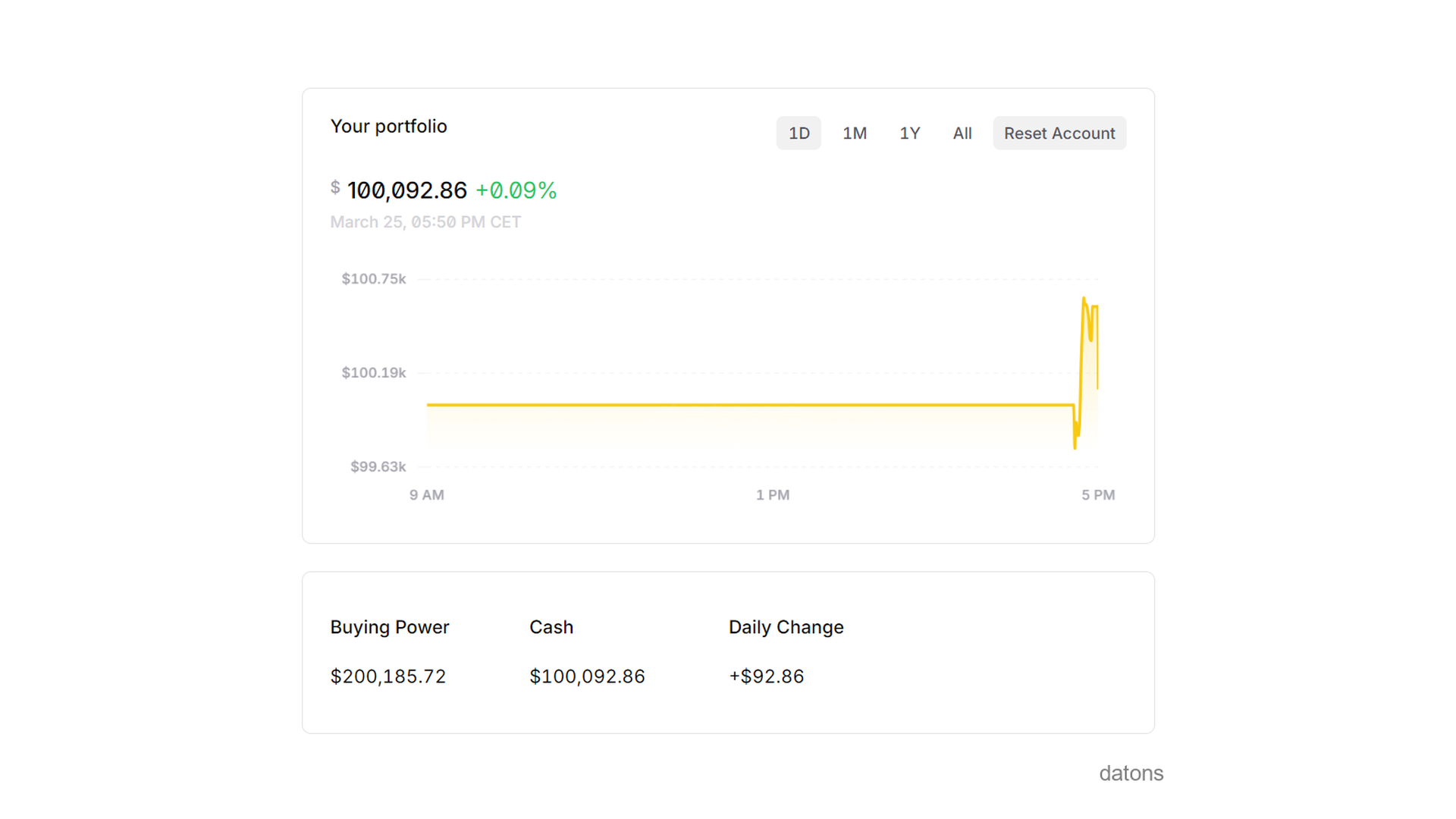

Finally, you’ll observe your portfolio with the updated balance on the Alpaca platform.

We noticed that the balance increased by $92.86 after the operations.

And that’s how you can use programming to make decisions that are reflected in reality using APIs.

Questions? Let’s talk below in the comments.

Conclusions

- Authorization for Trading Operations:

TradingClientin demo modepaper=Truefor operating with the trading API. - Demo Account Information:

client.get_accountretrieves information from the demo account, including balance and status. - Creation of a Buy Order:

client.submit_ordercreates and sends aMarketOrderRequestbuy order for an asset specifying details such as amount and price. - Use of GTC in Orders:

enums.TimeInForce.GTCestablishes that the order remains active until executed. - Closing an Open Position:

client.close_positioncloses an open position for a specific asset. - Updated Visualization of Operations: all information about the operations performed is reflected on the Alpaca platform.

If you could program whatever you wanted, what would it be? The upcoming tutorial might cover it ;)

Let’s talk in the comments below.